The SuperTrend indicator for binary options is a highly effective tool traders use to identify market trends and make informed trading decisions. Developed to simplify trend analysis, this indicator has become a staple in the toolkit of many successful traders.

In this review, we will explore the history and nature of the SuperTrend indicator, explain its key settings, and present a powerful strategy for trading OTC on Pocket Option (or other brokers) and regular pairs. We’ll also provide example calculations to demonstrate the potential profitability of using this strategy.

A Brief History of the SuperTrend Indicator

The SuperTrend indicator was developed to enhance trend-following techniques by providing clear and straightforward signals.

Its foundation lies in the Average True Range (ATR), a concept introduced by J. Welles Wilder in his 1978 book “New Concepts in Technical Trading Systems.” The ATR measures market volatility, and the SuperTrend builds on this by using the ATR to set dynamic stop-loss levels that move with the price.

The indicator’s simplicity and effectiveness have made it popular among traders looking for reliable trend signals.

Understanding the SuperTrend Indicator

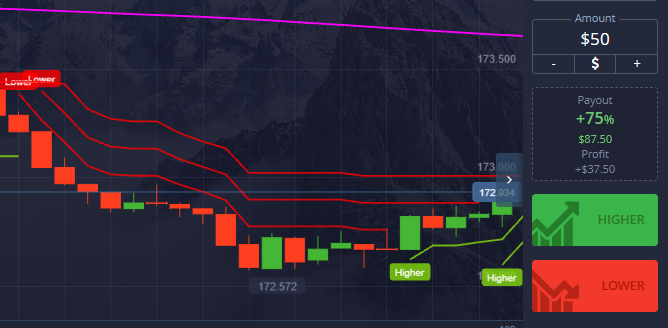

The SuperTrend indicator is a trend-following tool that overlays on the price chart, signaling the direction of the trend. It changes color based on the market’s trend: green for an uptrend and red for a downtrend. This visual representation helps traders quickly identify potential entry and exit points.

Key Settings of the SuperTrend Indicator

The SuperTrend indicator has two main settings:

- ATR Period: The number of periods used to calculate the Average True Range. This setting influences the sensitivity of the indicator to market volatility.

- Multiplier: This value multiplies the ATR to determine the distance of the SuperTrend line from the price. A higher multiplier places the line further away, reducing the number of signals but increasing their reliability.

For binary options trading, common settings for the SuperTrend indicator are an ATR period of 10 and a multiplier of 3. These settings can be adjusted to suit different trading styles and market conditions.

Strategy Using the SuperTrend Indicator for Binary Options

Now, let’s develop a robust strategy that applies to both OTC and regular pairs using the SuperTrend indicator for binary options trading.

Setup:

- Chart: 1-minute chart

- Trade Duration: 3 minutes

- Indicators:

-

- 200-period Simple Moving Average (SMA)

- SuperTrend (10, 1)

- SuperTrend (11, 2)

- SuperTrend (12, 3)

Trading Rules:

- Buy Signal:

-

- The price must be above the 200 SMA.

- All three SuperTrend indicators should show a buy signal (green line below the price).

- Sell Signal:

-

- The price must be below the 200 SMA.

- All three SuperTrend indicators should show a sell signal (red line above the price).

Implementation

- Identify the Trend: Use the 200 SMA to determine the overall trend. If the price is above the 200 SMA, look for buy signals. If it is below, look for sell signals.

- Confirm the Signal: Wait for all three SuperTrend indicators to align and confirm the same signal (buy or sell).

- Execute the Trade: Once all conditions are met, enter a trade in the direction of the signal. For buy signals, place a 3-minute call option; for sell signals, place a 3-minute put option.

Example Calculations: Achieving a 60% Win Rate

To illustrate the potential profitability of using this SuperTrend indicator strategy, let’s consider an example with a 60% win rate. Assume you make 10 trades per day, each with a $100 investment.

- Win Rate: 60%

- Total Trades per Month: 10 trades/day * 30 days = 300 trades

- Winning Trades: 60% of 300 = 180 trades

- Losing Trades: 40% of 300 = 120 trades

- Profit Calculation:

-

- Winning: 180 trades * $92 (net profit per winning trade) = $16,560

- Losing: 120 trades * $100 = $12,000

- Net Profit: $16,560 – $12,000 = $4,560

These calculations demonstrate that with a 60% win rate, which is achievable with disciplined trading and adherence to the strategy, significant monthly profits can be realized.

Complementary Indicators to Use with the SuperTrend

To maximize the effectiveness of the SuperTrend indicator for binary options, it’s beneficial to pair it with other complementary indicators such as the Aroon, Vortex, and Schaff Trend Cycle (STC) indicators. Each of these indicators adds a unique layer of analysis, helping to confirm signals and filter out false ones.

- Aroon Indicator: The Aroon indicator is excellent for identifying the strength of a trend and the likelihood of its continuation. It consists of two lines, Aroon Up and Aroon Down, which measure the number of periods since the highest high and the lowest low. When paired with the SuperTrend, the Aroon indicator can confirm the trend’s strength. For example, if the SuperTrend shows a buy signal and the Aroon Up is above the Aroon Down, it reinforces the bullish signal, making it more reliable.

- Vortex Indicator: The Vortex indicator helps to identify the start of a new trend and confirms the direction of the current trend. It features two lines that capture positive and negative trend movements. When these lines cross, it signals a potential change in trend direction. Using the Vortex indicator alongside the SuperTrend can help traders validate entry points. For instance, a buy signal from the SuperTrend combined with a bullish crossover on the Vortex indicator can give traders additional confidence to enter a trade.

- Schaff Trend Cycle (STC): The STC is a versatile indicator that combines aspects of the MACD and stochastics to provide early and accurate signals of trend changes. It is particularly useful for identifying both trending and ranging market conditions. When used with the SuperTrend, the STC can help identify optimal entry and exit points. For example, if the SuperTrend gives a sell signal and the STC is also indicating a bearish cycle, it can confirm the downtrend, enhancing the overall trading strategy.

By integrating these indicators with the SuperTrend, traders can create a more robust binary options trading system that provides multiple layers of confirmation, reducing the likelihood of false signals and improving overall trading accuracy.

Tips for Success

- Avoid Overtrading: Limit your trades to 5-10 carefully selected ones per day to avoid emotional decision-making and reduce risk.

- Backtest Your Strategy: Before using these strategies on a live account, backtest them extensively to understand their performance under different market conditions.

- Use a Demo Account: Practice on a demo account to refine your skills and build confidence without risking real money.

A Super Indicator!

The SuperTrend indicator for binary options is a valuable tool for identifying market trends and making informed trading decisions.

By understanding its settings and applying a well-structured strategy, traders can enhance their trading performance in both OTC and regular markets.

With disciplined trading and a focus on continuous improvement, achieving a consistent 60% win rate is within reach, leading to substantial profits.

If you found this article helpful, please comment below and share it with others who might benefit from these insights. Happy trading!

Mark.

Affiliate Links Disclosure:

Some links in our articles are affiliate links. This means we may earn a commission if you deposit through these links, at no extra cost to you. These commissions help us keep providing high-quality, free information to our readers. We only recommend products and services we trust and find valuable. In addition, using our links you will get FREE access to copy our trades automatically.

Risk Disclaimer:

Trading binary options involves significant risk and may not be suitable for all investors. You could lose all of your capital. Always conduct thorough research and seek advice from a qualified financial advisor before making any investment decisions.

Leave a Reply